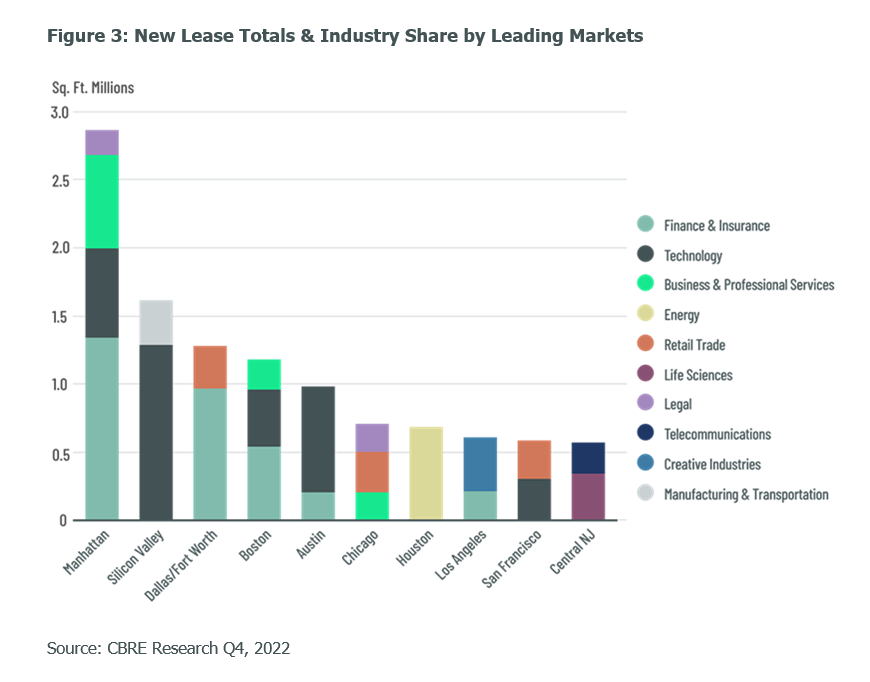

Finance & insurance companies replaced technology firms for the highest share of the top 100 U.S. office leases in 2022. The 100 largest leases, totaling 30.3 million sq. ft. in 2022 vs. 30.7 million sq. ft. in 2021, accounted for 15.5% of total U.S. office leasing last year vs. 15.0% in 2021. New leases, both direct and sublease, accounted for 53% of the top 100, down from 61% in 2021. Rising interest rates and higher construction costs likely influenced larger occupiers to stay in their current space and renew rather than incur build-out costs associated with a new lease.

Finance & insurance companies accounted for 25 of the top 100 leases last year, more than double their share in 2021 and nearly one-quarter (7.4 million sq. ft.) of the top 100’s total square footage. Sixty percent of the finance & insurance sector’s total was in new leases, mostly in the Northeast. Technology firms accounted for 17 of the top 100 last year, down from 36 in 2021 due to the impact of hybrid work on the sector.

The government/non-profit sector accounted for nine of the top 100 leases, totaling 4.4 million sq. ft., down from 16 in 2021 and primarily in the Mid-Atlantic region. Other sectors with more leases in the top 100 than in 2021 were business & professional services, creative industries, retail trade, energy and manufacturing & transportation.

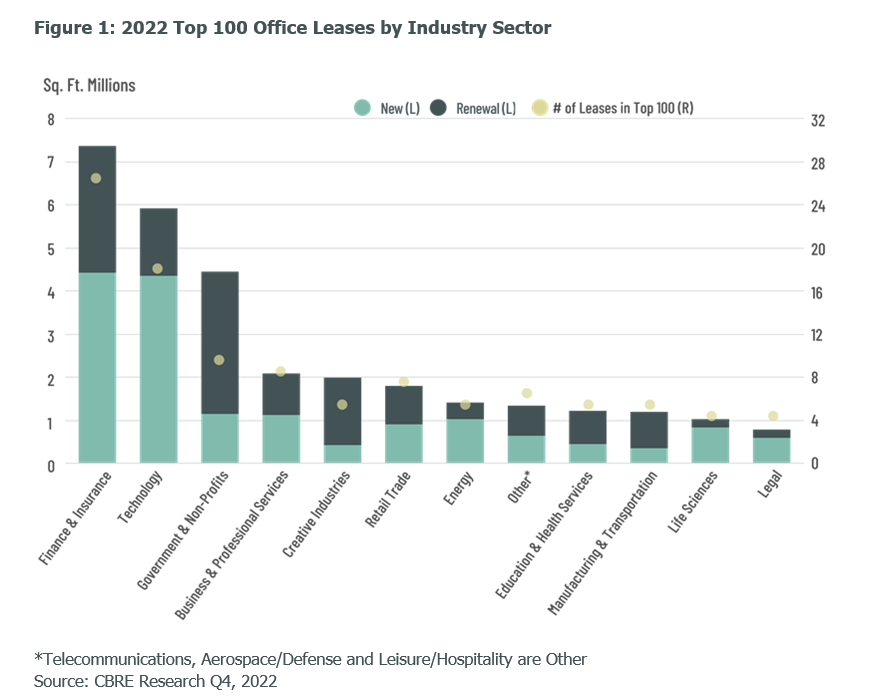

The Northeast and Pacific regions accounted for the biggest total square footage shares of the top 100. Manhattan, Northern Virginia and Silicon Valley were the top three markets for total leasing activity, including renewals, accounting for 33% of the square footage total.

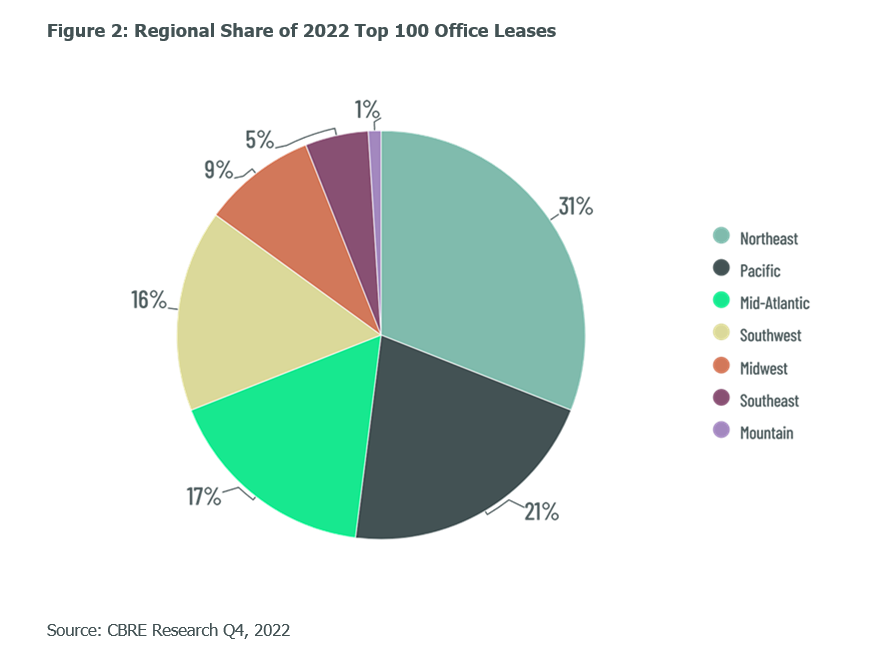

Manhattan, Silicon Valley and Dallas/Fort Worth were the top three markets for new leasing activity among the top 100, primarily driven by the finance & insurance and technology sectors. The three markets accounted for 36% of the total new leasing activity.