Apartment rents have become highly correlated with remote work and return-to-office trends.

Apartment rents fell in most major tech cities during the pandemic’s early months as the tech industry enthusiastically embraced remote work. Untethered to the physical office, many tech employees moved to the suburbs, second-home communities or smaller, less densely populated cities. As more people returned to major cities and began to work from the office again, at least part of the time, tech market apartment rents reversed course.

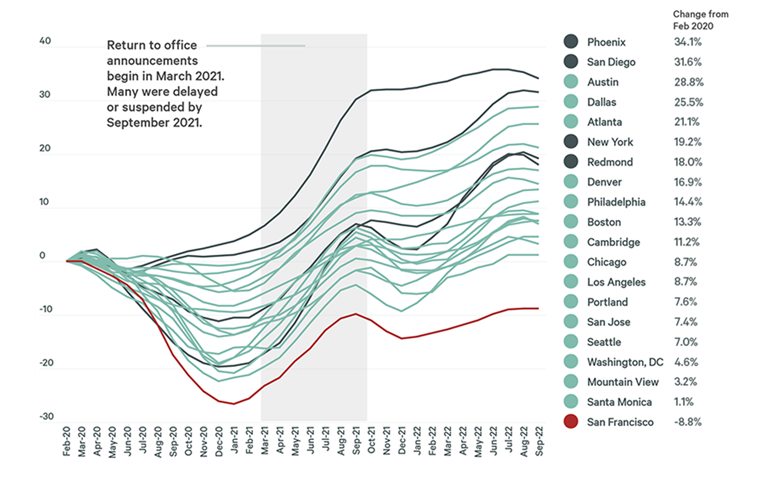

According to Apartment List, the median rent for 20 key U.S. tech cities bottomed out in December 2020. Eighteen cities saw declines, ranging from 26% in San Francisco to 1% in Atlanta. Phoenix and San Diego were the only major cities where apartment rents rose, benefiting from net in-migration early in the pandemic. Apartment rents began to climb again in spring 2021 when companies attempted to execute return-to-office plans. However, when COVID-19 cases spiked in fall 2021, most companies delayed their office return and the apartment rent recovery stalled.

As return-to-the-office plans have regained momentum this year, apartment rents have resumed their rise. All 20 tech cities have rent levels at least equal to pre-pandemic highs. San Francisco is the exception as apartment rents remain 8.8% below the February 2020 level. Phoenix and San Diego continue to set the long-term pace for apartment rent growth, with gains of 34% and 32%, respectively, since February 2020. However, the biggest gains this year have occurred in Redmond, WA, and New York City where apartment rents are up 16% and 12%, respectively.

FIGURE 1: Apartment Rents in 20 Key U.S. Tech Cities

Source: Apartment List and CBRE Tech Insights Center, September 2022.