REBOUND EXPECTED IN Q3 AFTER RECORD DROP IN EMPLOYMENT

The record number of jobs lost over the past two months should begin coming back in Q3 and be largely regained by the end of 2021, according to an analysis by CBRE.

Over the past several weeks, 33.5 million workers filed initial claims for unemployment, indicating that the 23 million jobs gained over the past 10 years were suddenly erased. Jobs lost in April alone totaled 20.5 million—the largest one-month drop in the post-World War II period. The good news is that most job losses were reported as “temporary” and should begin returning in Q3 as an expected economic recovery takes hold.

Most Affected Industries

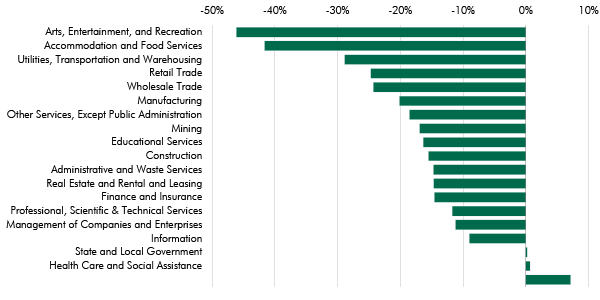

Figure 1: Forecast Employment Change in Q2 by Industry

Source: CBRE Econometric Advisors, Oxford Economics, Q2 2020.

The industries most affected by mandatory shutdowns unsurprisingly are those that depend most on human interaction—hotels and restaurants. While still relatively insulated, the office, industrial and health care sectors had significant job losses in April. The office sector lost 2.4 million jobs, while industrial (largely manufacturing) and health care (largely ambulatory services) each lost 1.4 million jobs.

On an aggregate basis, the retail trade, hotel and food services sectors are forecast to account for more than 40% of the 24 million total jobs lost in Q2. Traditional office-using employment, such as professional business services and FIRE, are expected to account for 18%, while manufacturing will account for 11% and education for only 3%. April’s job losses mirror these percentages for the most part.

Forecast & Timing for Bounce Back

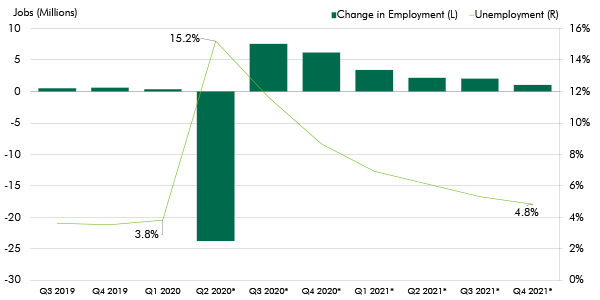

Figure 2: Forecast Change in Employment & Unemployment Rate

*Forecast

Source: CBRE Econometric Advisors, Oxford Economics, Q2 2020.

Overall, one-third of the jobs lost in Q2 are expected to be regained in Q3. Office-using employment is expected to return 40% to 50% of its lost jobs by Oct. 1, while retail and restaurants will regain only 25% to 30%. Nearly all lost jobs should be regained by the end of 2021. The resurgence in employment will be driven by the temporary nature of the current losses and the current projected timeline for states to begin the first phase of reopening their economies.

Some states, such as Illinois, Washington and California, require larger firms (generally greater than 100 employees) to classify layoffs as either permanent or temporary. Before March 2020, most layoffs in these states were categorized as permanent; less than 1% had ever been categorized as temporary.

Since March of this year, however, approximately 70% to 90% of all layoffs have been designated as temporary. The April jobs report from the Bureau of Labor Statistics confirmed this trend, with 79.4% of all unemployed persons reporting themselves as temporarily laid off. These indicators suggest that as states begin to ease restrictions, many of the temporarily lost jobs will return, although some likely will become permanent.

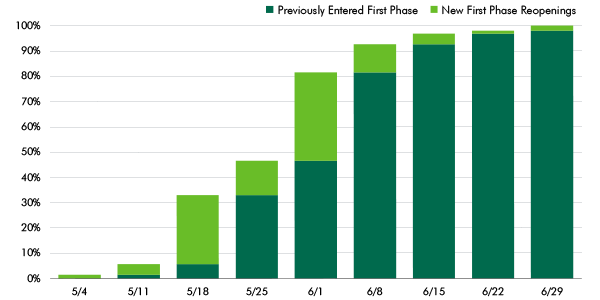

Figure 3: Share of Total Employment by Projected First-Phase Reopening Date

Source: CBRE Research, Deutsche Bank, Q2 2020.

Most states are expected to begin restarting their economies by the end of Q2. More than 80% of employment is driven by economies that may begin reopening by mid-Q2, providing enough time to begin showing job recreation by the end of June. This timeline would pave the way for a much-needed return by many affected workers beginning in Q3.

A return to job growth is an important piece of the recovery story for real estate markets. With a jobs market rebound in Q3, a real estate recovery should follow beginning in 2021.