MIDDLE EASTERN REAL ESTATE INVESTORS SPEND 73% OF OUTBOUND CAPITAL IN EUROPE IN 2014

- $ 10.2 Billion Spent on European Commercial Real Estate in 2014 -

- Middle East the Third Largest Source of Cross-regional Capital Globally -

- Saudi Arabia Fastest Growing Middle Eastern Investor -

Dubai, 14 April 2015 – Middle Eastern buyers invested a total of $ 14.1 billion outside their home region in 2014, making the Middle East the third largest source of cross-regional capital globally, despite a fall in total spend, according to CBRE’s “Middle East In and Out 2015” report.

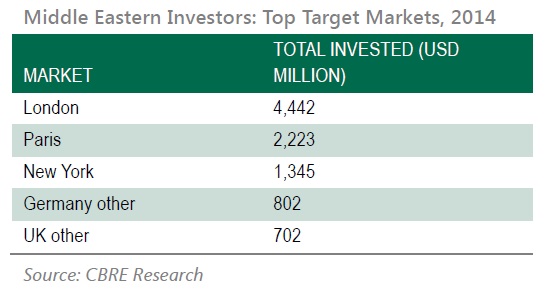

Europe remains the preferred market for Middle Eastern investors, receiving $ 10.2 billion in 2014. In line with other investor groups, the year saw a major shift in investment strategies, with activity growing across second-tier European locations, including Amsterdam, Frankfurt, Budapest and Madrid. While still the most popular market, London received 32% of spend in 2014 compared to 45% in 2013, with Paris and New York growing their shares in 2014 to 16% and 10% respectively. London and Paris were the only two markets to retain a top five ranking in 2014.

Iryna Pylypchuk, Director, Global Capital Markets Research, CBRE, commented:

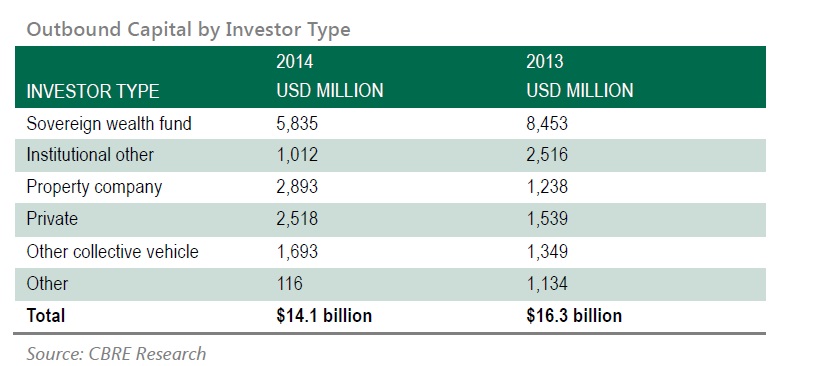

“There was a fall in outbound capital from the region from $ 16.1 billion invested globally in 2013 to $ 14.1 billion last year. In part, this is a function of difficulty in accessing product, and the large lot sizes these buyers tend to invest in. However, looking ahead and in light of weaker oil pricing, real estate acquisitions by sovereign wealth funds are expected to slow further in 2015 and beyond.”

Historically, sovereign wealth funds have dominated Middle Eastern investor league tables – accounting for around 50% of international commercial real estate acquisitions in 2013. While still the largest single investor group, Middle Eastern high net worth individuals, the private sector and other collective vehicles played a more significant role in role in global real estate markets in 2014.

Pylypchuk added, “In contrast to SWFs, lower oil prices may have triggered private capital to increase international allocations and speed up deployment faster than would have been the case otherwise. Our research clearly shows a greater allocation of investment to real estate and desire to diversify away from the home region. This has had a significant impact on Europe, where the combined investments of private wealth and equity funds from the Middle East grew by 49% year-on-year to $ 5.5 billion.”

Saudi Arabia is the fastest growing source of outbound Middle Eastern investment. Capital outflows from the Kingdom grew rapidly in 2014, with $ 2.3 billion invested vs. nothing in 2013. Qatar was the largest source of Middle Eastern capital in 2014, with $ 4.9 billion invested.

While an overall drop in spend was recorded, Nick Maclean, Managing Director, CBRE Middle East, added: “Middle East investors’ overseas real estate spend has grown amongst private and family offices and Saudi investors, as geographical diversification has become more important. We feel that this trend will accelerate over the next few years.”

MIDDLE EAST INCREASE IN CROSS-REGIONAL CAPITAL AND ITS IMPACT