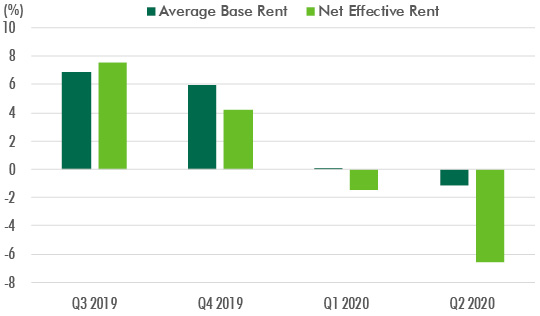

Office lease concessions in the form of free rent and tenant improvement allowances rose sharply in Q2 2020 as U.S. office demand fell by its biggest amount since 2009. Amid reduced leasing activity, base rents for office space in the 15 largest U.S. markets generally remained stable. Instead, property owners provided more favorable concessions to tenants, causing net effective rents to fall.

Figure 1 shows this divergence, with base rents declining by only 1.1% in Q2 from one year ago, while net effective rents fell by 6.6% over the same period. Rent changes in the 15 largest markets were more severe than the national average due to the COVID-19 crisis affecting big cities more acutely.

Figure 1: One-Year Change in Average Office Rents

Source: CBRE Research, Q3 2020

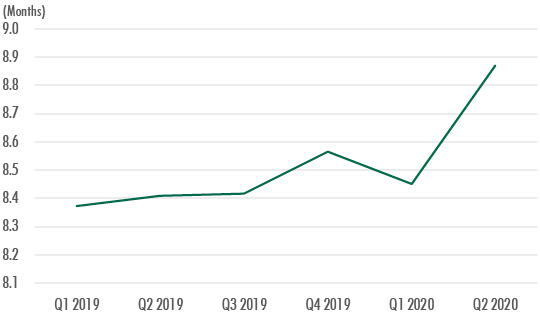

Longer periods of free rent primarily drove net effective rents lower in Q2. Figure 2 shows the spike in free rent offered in Q2 as a four-quarter average. For Q2 alone, free rent averaged 10 months, up by 13.7% from Q1.

Tenant improvement allowances rose by 5.1% quarter-over-quarter in Q2 to $75.57 per sq. ft. The increase in these allowances may have been limited by declines in construction pricing, as evidenced by the Q2 drop in the Turner Building Cost Index for the first since 2010.

Office market fundamentals will remain challenged in the near term and likely will fuel further concessions. Even though a low level of transactions may hinder efficient price discovery for a while, occupiers are potentially positioned to secure very advantageous terms right now. However, the U.S. economic recovery is ongoing and if a vaccine for COVID-19 is found by the end of the year, these tenant-favorable conditions may not last long.

Figure 2: Average Months of Free Rent on Lease Transactions (4-qtr. Average)

Source: CBRE Research, Q3 2020.

SHARE

Office lease concessions in the form of free rent and tenant improvement allowances rose sharply in Q2 2020 as U.S. office demand fell by its biggest amount since 2009. Amid reduced leasing activity, base rents for office space in the 15 largest U.S. markets generally remained stable. Instead, property owners provided more favorable concessions to tenants, causing net effective rents to fall.

Figure 1 shows this divergence, with base rents declining by only 1.1% in Q2 from one year ago, while net effective rents fell by 6.6% over the same period. Rent changes in the 15 largest markets were more severe than the national average due to the COVID-19 crisis affecting big cities more acutely.

Figure 1: One-Year Change in Average Office Rents

Source: CBRE Research, Q3 2020.

Longer periods of free rent primarily drove net effective rents lower in Q2. Figure 2 shows the spike in free rent offered in Q2 as a four-quarter average. For Q2 alone, free rent averaged 10 months, up by 13.7% from Q1.

Tenant improvement allowances rose by 5.1% quarter-over-quarter in Q2 to $75.57 per sq. ft. The increase in these allowances may have been limited by declines in construction pricing, as evidenced by the Q2 drop in the Turner Building Cost Index for the first since 2010.

Office market fundamentals will remain challenged in the near term and likely will fuel further concessions. Even though a low level of transactions may hinder efficient price discovery for a while, occupiers are potentially positioned to secure very advantageous terms right now. However, the U.S. economic recovery is ongoing and if a vaccine for COVID-19 is found by the end of the year, these tenant-favorable conditions may not last long.

Figure 2: Average Months of Free Rent on Lease Transactions (4-qtr. Average)

Source: CBRE Research, Q3 2020.

________________________________________

Contacts

Richard Barkham, Ph.D., MRICS

Global Chief Economist & Head of Americas Research

CBRE Americas and Global Research

+1 617 912 5215

richard.barkham%m%cbre%d%com

Spencer Levy

Chairman & Senior Economic Advisor

CBRE Americas Research

+1 617 912 5236

spencer.levy%m%cbre%d%com

Julie Whelan

Head of Occupier Research

CBRE Americas Research

+1 617 912 5229

julie.whelan%m%cbre%d%com

Ian Anderson

Senior Director of Research

CBRE Americas Research

+1 215 561 8900

ian.anderson2%m%cbre%d%com

Deepak Dewani

Vice President

CBRE Americas Research

+1 703 905 0322

deepak.dewani%m%cbre%d%com