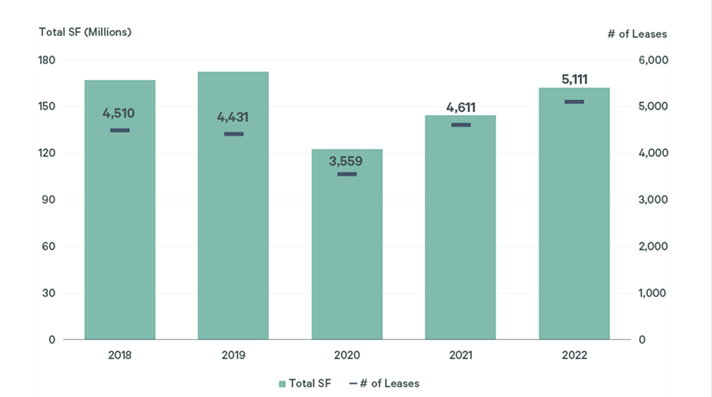

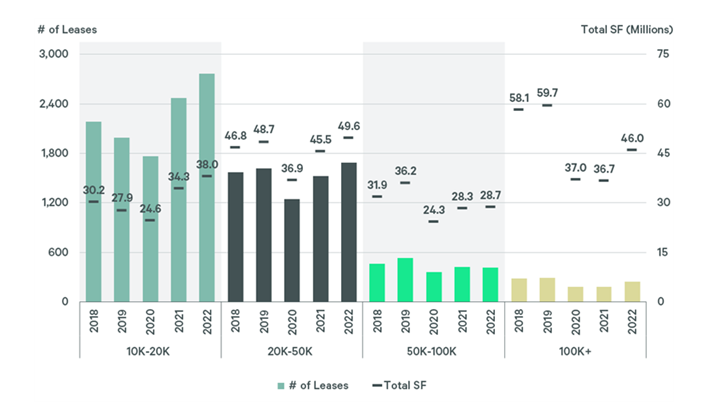

With fewer employees regularly in the office, many companies are lowering their office size requirements. Although the number of U.S. office leases in the first three quarters of 2022 was 14% higher than the pre-pandemic (2018/2019) average, total square footage leased was down by 4%. The number of small leases (10,000 to 20,000 sq. ft.) increased by 32%, while those for spaces of 100,000 sq. ft. or more decreased by 17%. The increase in smaller leases this year reduced the average lease size by 18% compared with the pre-pandemic average.

Over the same period, leases for between 50,000 and 100,000 sq. ft. fell by 16%, while those for between 20,000 and 50,000 sq. ft. grew by 6%.

Two factors are driving demand for smaller spaces: Smaller companies are leading the return to office, while larger companies are reducing their footprints due to less office utilization and the need for cost savings.

Figure 1: Total Number of Office Leases & Square Footage Volume, 2018-2022*

*Data through Q3 of each year. Data consists of leases 10K sq. ft. and greater.

Source: CBRE Research, Q3 2022.

Figure 2: Total Number of Office Leases & Square Footage Volume by Lease Size, 2018-2022*

*Data through Q3 of each year.

Source: CBRE Research, Q3 2022.

Occupiers are reassessing their leasing requirements amid lower office utilization and economic headwinds. While most appear to accept hybrid work as a "new normal," they still see the office as vital for business success. Since this has translated into more demand for smaller leases in high-quality buildings, landlords should consider offering "plug-and-play" spec suites and flex space by subdividing large blocks of space to attract a larger pool of smaller tenants and improve leasing velocity.