Explore Market Rents

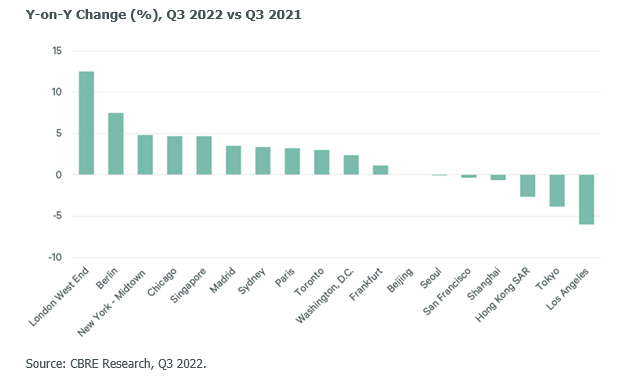

Despite continued economic headwinds from high inflation and rising interest rates, global office markets were relatively stable in Q3 2022. Several markets with tight supply conditions recorded prime rent growth.

In the Americas, prime rents increased in 21 of the 33 main office markets year-over-year in Q3, on par with the 20 markets that had annual growth in Q2. Downtowns dominated for prime rent growth in the main office markets, including eight of the top 10 for rent growth. In the U.S., leasing activity slowed as occupiers continued to delay leasing decisions due to economic uncertainty and sublease space reached a record high of 169 million sq. ft. Houston (+17.6%), Vancouver (+15.5%) and Dallas (+15.4%) led major markets for annual prime rent growth in Q3. The biggest year-over-over declines occurred in Los Angeles and Montreal. In Q3, U.S. office demand was positive for the fourth consecutive quarter but nominal. Amid rising uncertainty around higher interest rates and inflation, we expect slower leasing activity in the near term.

In EMEA, office leasing activity increased by 9% year-over-year in Q3 and was up by 24% up on a year-to-date basis. Berlin, Milan and Madrid had particularly strong leasing activity in Q3, while Barcelona, London and Munich were relatively weak. CBRE forecasts a 10% increase in EMEA office leasing activity this year, although market sentiment remains uncertain amid a global economic slowdown. The supply deficit of high-quality prime office space continues to put a strain on several markets. As a result, we expect weaker leasing activity in the first half of 2023 before stabilizing in the second half.

In APAC, office leasing activity weakened in Q3 despite a moderate uptick in Japan and mainland China. Flight-to-quality relocation remained the most popular leasing strategy, often involving consolidation and cost-saving motives due to economic headwinds. Mainland China’s tech giants continued to terminate leases and consider withdrawing from early commitments in some locations. Regional rent growth nevertheless gathered momentum over the quarter as effective rent growth in Sydney and Brisbane accelerated due to tightening incentives. Tightly supplied markets such as Seoul and Singapore continued to see rent growth, with the latter seeing Grade A rent surpassing the pre-pandemic peak recorded in Q4 2019. However, rents in mainland China, Hong Kong and Tokyo registered further declines. Full-year leasing volume is expected to stay flat in the region. While occupiers will be cost cautious in the face of mounting economic challenges, the release of more quality space next year could trigger more relocations and consolidation. Full-year leasing volume in 2023 is forecast to grow by as much as 5%.