Executive Summary

• The Consumer Price Index (CPI) rose by 7.7% year-over-year in October, below consensus estimates of 7.9% and down from the 8.2% rate in September.

• Core inflation, which excludes food and energy prices and is the Fed’s preferred measure, increased by 6.3% year-over-year, down from 6.6% in September. Nevertheless, it remains well above the Fed’s 2% target.

• Slower inflation means that the Fed’s four consecutive 75-basis-point rate hikes are beginning to take effect and likely will allow the central bank to lower the size of additional increases, starting with a 50-bp hike in December.

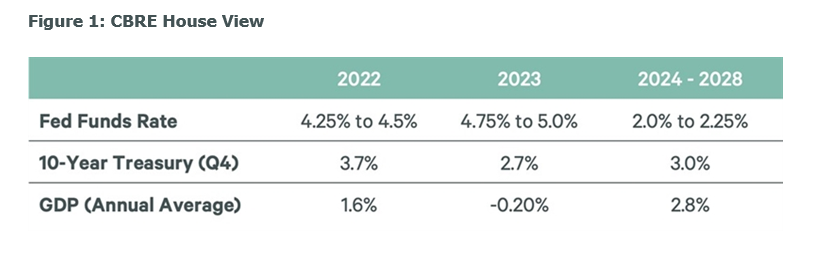

• CBRE expects inflation will end the year at 7.6% and fall to 3.5% by year-end 2023. As a result, the federal funds rate should top out at between 4.75% and 5% next year.

The Bottom Line

A slight easing in inflation last month will allow the Fed to reduce the size of additional interest rate increases. We expect inflation will continue to cool but remain above the Fed’s 2% target throughout 2023. As such, we expect the Fed will continue hiking rates, with a 50-bp increase in December and additional 25-bp hikes likely in 2023. As the lagged effect of higher interest rates reduces demand across the economy, including for real estate, we expect inflation to further ease.

However, the Fed will not loosen monetary policy for several quarters, precipitating a mild U.S. recession during the first half of 2023. This in turn will cause real estate investment volume to remain subdued before beginning to recover around midyear. Leasing activity should begin to recover in the second half of 2023.