• The Federal Reserve Bank announced today that it may allow inflation to remain above the target level of 2% to compensate for preceding periods of below-target inflation.

• This is a major policy shift that signals the federal funds rate will stay “lower for longer.”

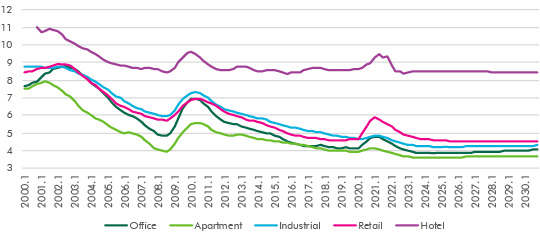

• “Lower-for-longer” interest rates will put downward pressure on cap rates, particularly in real estate sectors where fundamentals are firm.

• Cap rate increases were already expected to be less severe than in prior economic downturns due to the Fed’s aggressive quantitative-easing program and today’s announcement should limit them further.

• An adjustment to the Fed’s monetary policy had been under discussion prior to the COVID-19 shock, but the prospect of falling prices has crystalized the Fed’s thinking.

Figure 1: U.S. CPI Inflation

Source: Federal Reserve Bank of St. Louis, August 2020.

The Bottom Line

The Federal Reserve announced today that it will allow inflation to run above its target of 2% after times of persistently low inflation before considering rate increases. The policy change is intended to mute concerns that inflationary pressure from government fiscal and monetary stimulus could cause the Fed to raise rates prematurely. Inflation has often been below the Fed’s 2% target for some time.

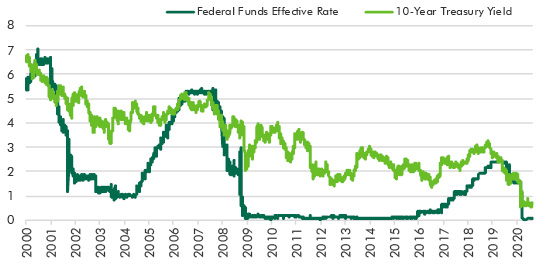

Figure 2: Fed Funds vs. 10 Yr Treasury

Source: Federal Reserve Bank of St. Louis, August 2020.

Higher inflation has historically been a double-edged sword for commercial real estate. While it has enhanced equity flows into commercial real estate as an “inflation hedge,” it also presents the risk of higher debt costs. The Fed’s announcement will make commercial real estate more attractive as an inflation hedge. While the risk of premature rate hikes is lower, we will have to be vigilant about the bond market's reaction when the economy gains strength.

Figure 3: Cap Rate History and Forecast

CBRE Econometric Advisors, August 2020.

The Fed’s increased tolerance for some inflation will further bolster the case of “lower for longer” interest rates and put greater downward pressure on long-term cap rate movement. The Fed has already flooded the market with liquidity to lessen COVID-19’s economic impact and this has substantially reduced levels of corporate debt defaults.

________________________________________

Contacts

Richard Barkham, Ph.D., MRICS

Global Chief Economist & Head of Americas Research

CBRE Americas and Global Research

+1 617 912 5215

richard.barkham%m%cbre%d%com

Spencer Levy

Chairman & Senior Economic Advisor

CBRE Americas Research

+1 617 912 5236

spencer.levy%m%cbre%d%com

Darin Mellott

Director of Research

CBRE Americas Research

+1 801 869 8014

darin.mellott%m%cbre%d%com