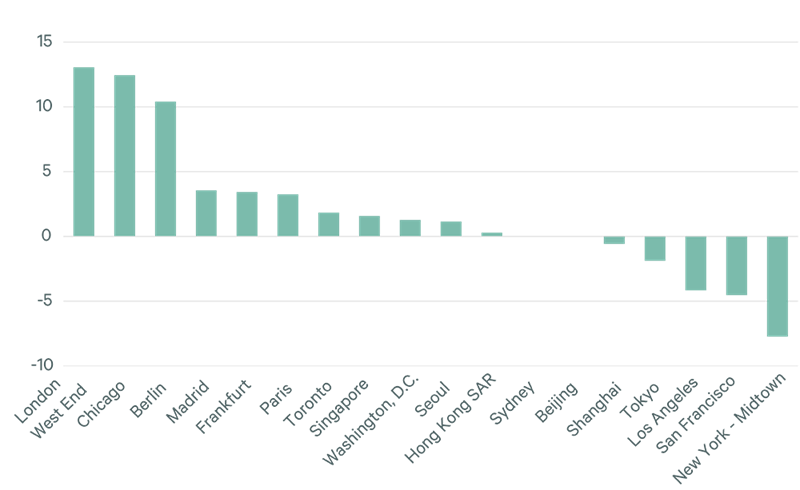

Despite economic headwinds including high inflation and rising materials costs, global office markets exhibited relative strength in Q2 2022. Office take-up and prime rent increases occurred in several key markets across the three main global regions, reflecting recovering demand and improved leasing activity.

In the Americas, prime rents increased in 18 of the 33 main office markets over the year ending in Q2 2022, down from 25 markets that had seen annual growth in Q1 2022. The slowdown in rent growth was widespread throughout downtown and suburban markets in the U.S., Canada and Latin America. In the U.S., leasing activity has decreased for the past two quarters as concerns about the macro economy and office utilisation rates caused some occupiers to delay decisions. Suburban Dallas and Downtown Montreal had the biggest year-over-year declines in rental rates. São Paulo (+20.0%), Denver (+12.7%) and Vancouver (+12.2%) led major markets for prime rent growth year-over-year in Q2. Demand is expected to strengthen in the second half of the year as tenant requirements are near pre-pandemic levels.

In EMEA, rents generally continue to be supported, with the EMEA office rent index up by over 5% Y-o-Y in Q2. It was a reasonably strong quarter for leasing too with aggregate office leasing 30% up on the same quarter in 2021. Madrid and London City had particularly strong quarterly take-up rates and prime rent growth. Demand continues to stem from appetite for high-quality spaces with premium amenities. This comes at a time when corporates are focused on magnetising a return to the office for their employees in an effort to increase office occupancy levels. Consequently, the widening spread continues as Grade A space dominates take-up volume in most major European cities, whilst vacancy levels are largely driven by higher vacancy in peripheral secondary submarkets. On the supply side, economic headwinds and geopolitical tensions have led to labour shortages which, coupled with rising commodity prices, has produced a slowdown in new stock coming to the market. In terms of expected growth levels in 2022, continued short-term uncertainty has led to a revised projection for leasing activity to 5% (down from 10%).

In APAC, demand for prime buildings remained strong as occupiers continued to pursue flight-to-quality relocations that in some cases involved downsizing. Higher fit-out costs are prompting some occupiers to renew leases or seek fully fitted space or turnkey solutions from landlords as budget approvals become harder to secure. India saw a significant uptick in leasing volume in Q2 following the release of pent-up demand as cities reopened. APAC leasing volume declined slightly in Q2 as transactions were constrained by sector consolidations and lockdowns in key Chinese cities, coupled with tight availability in Seoul and Singapore. Seoul and Australian markets registered rent gains with declining incentives. However, rents declined for a ninth consecutive quarter in Tokyo and fell in almost all mainland China markets. While China is expected to see a mild recovery later this year and demand recovery should continue in India, regional leasing activity likely will moderate in H2 2022 due to mounting economic headwinds, rising fit-out costs and less availability of prime space. 2022 full-year leasing volume is expected to be flat or slightly down.

Y-on-Y Change (%), Q2 2022 vs Q2 2021

Source: CBRE Research, Q2 2022.