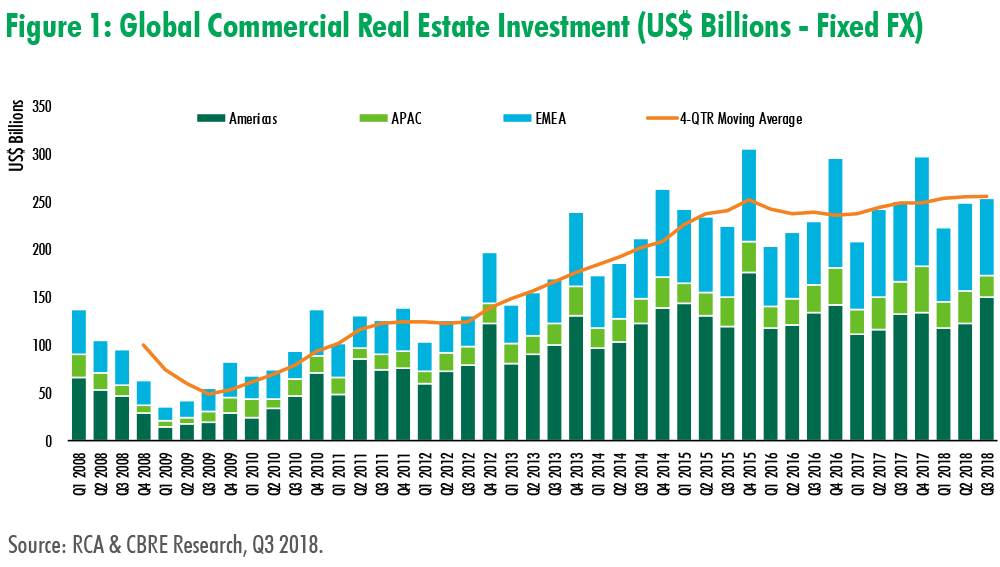

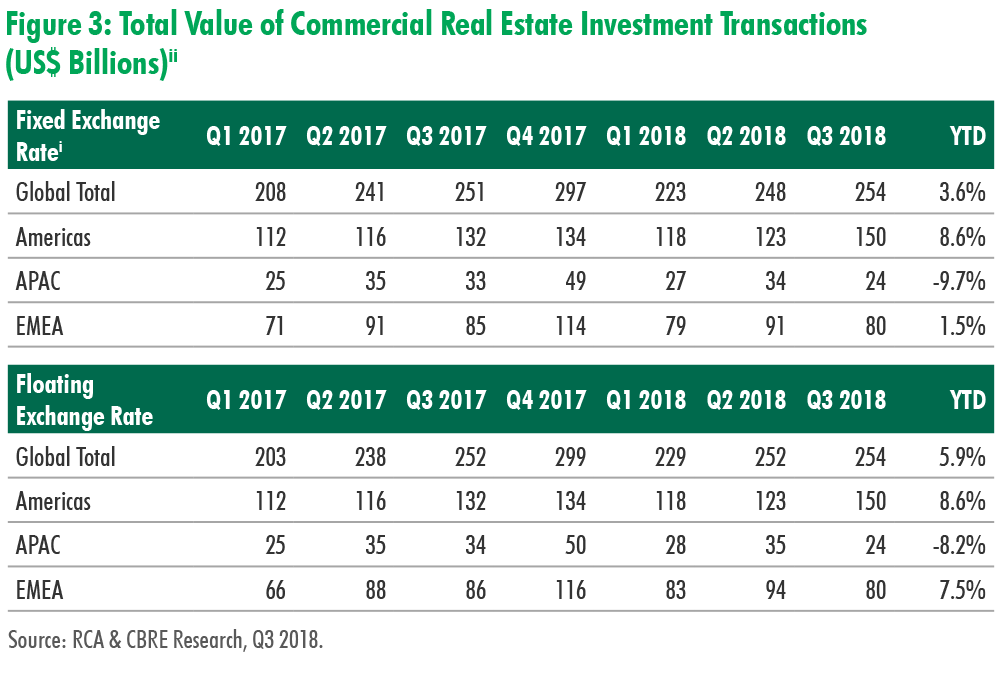

Large-ticket commercial real estate (CRE) mergers and acquisitions have leveled 2018 with 2015, the banner year for global real estate investment in the current cycle. Global investment volume increased 3.6% year-to-date (YTD), compared to the same period last year, with Q3 up by 1.2% (in fixed exchange rates).i Taking account of last year’s strong appreciation of the U.S. dollar and its discounting impact on other currencies, global investment volume grew by a greater 5.9% YTD (in floating exchange rates; Figure 3). The U.S. market, accounting for more than half of the global transactions, registered a 17% year-over-year increase in Q3 and significantly boosted the overall growth.

Americas investment volume YTD was up 8.6% from the same period last year, and Q3 volume was up 13.3% year-over-year. The surge in activity was enhanced by substantial entity transactions such as Brookfield’s US$15 billion takeover of GGP and Prologis’ US$8.5 billion acquisition of DCT Industrial Trust. Excluding entity transactions, Americas investment volume increased 2.3% in Q3 and 2.8% YTD. The hotel and multifamily sectors registered 23% and 14% YTD growth, respectively, driven by markets with high population growth such as Houston, San Antonio and Phoenix. Office sales rebounded after a relatively soft H1 and increased 13% in Q3. Manhattan, Seattle and Chicago contributed considerably on the upside. The levels of industrial and retail property sales decreased year-over-year but were more than offset by the surge in mergers and acquisitions.

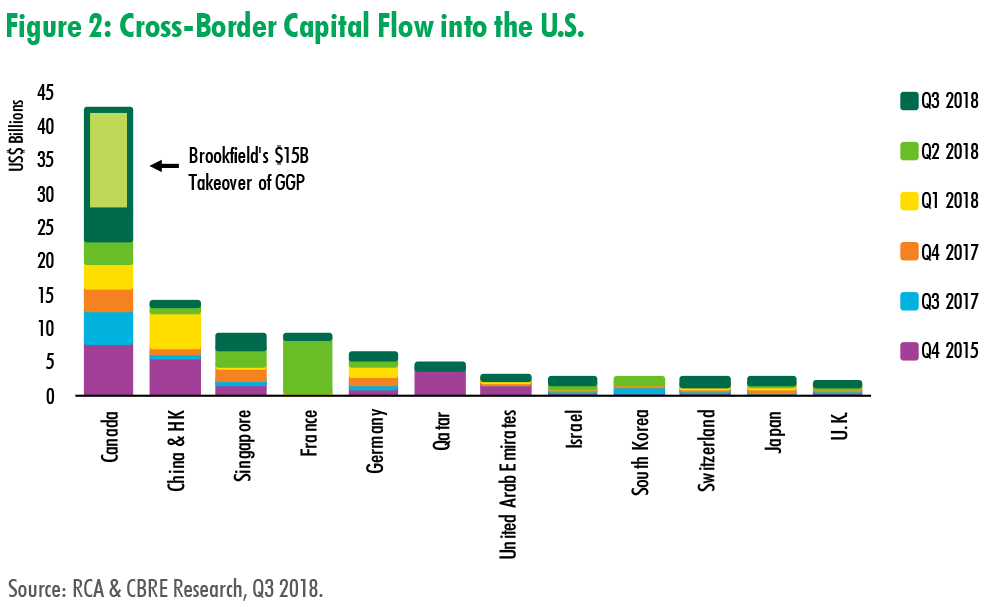

Cross-border investment into the U.S. market exceeded US$28 billion (including entity transactions) or 18% of the total investment in Q3, the second-largest quarter for capital inflow behind Q4 2015. Investment originating from Canada and Singapore made up 80% of the total inbound activity. Excluding Brookfield’s US$15 billion takeover of GGP, Canada’s capital inflow was 3% down YTD from the same period in 2017. Significant year-over-year growth in Q3 came from Singapore (216%) and low-interest-rate countries led by Japan (173%) and Switzerland (165%). Year-to-date, capital inflows from Singapore, Switzerland and Germany grew 35%, 53% and 13%, respectively, on already large investment bases. Most of these investments were direct property purchases across market tiers, in which EMEA investors continued to exhibit a strong appetite for office properties while APAC investors shifted toward industrial assets. Chinese capital inflow decreased by 14% YTD, or 5% if combined with capital from Hong Kong. As interest rates continue to rise, more international capital should flow into the U.S. Tier II and III markets in pursuit of higher yields.

Investment in European real estate grew 1.5% YTD following a record year in 2017. Q3 European investment volume totaled US$80.5 billion, the second-strongest Q3 on record. The YTD volume growth was largely driven by strong activity in Germany, France and Spain. Germany continued to experience robust growth in 2018, with an increase of 12% YTD compared to 2017, and investment volume of US$22.7 billion. This has been largely driven by a strong residential market and office sales in the top-five German cities. While growth in France eased in Q3, investment volume in the first three quarters is at the highest level since 2007. Uncertainty remains in the U.K., where investment volume slightly fell by 4% YTD, while primary markets such as London have been very resilient to geopolitical risks and continued to attract capital from around the world.

APAC investment volume fell by a total of 29% year-over-year in Q3 relative to a strong Q3 2017. Korea was the bright spot with 29% year-over-year growth, thanks to large-ticket trophy office transactions. Year-to-date, total investment has decreased by 9.7% in the region, but New Zealand, Taiwan and Hong Kong have posted solid growth due to strong office investments. In many other markets, especially China, investor sentiment was somewhat affected by rising trade tensions and stock market volatility. However, a rising trend of logistics mergers and acquisitions boosted industrial property investment in China. Retail property sales fared well in China and Taiwan, where consumer spending kept growing. Looking forward, an unfavorable lending environment, including higher mortgage rates, remains a downside risk in the APAC region. Investors fearing the volatility of the stock market may transfer more into real estate, which is perceived as much safer and positioned equitably for higher allocations.

According to Richard Barkham, CBRE’s Global Chief Economist, “Although interest rates are slowly rising, global growth is strong and investors remain committed to real estate. We see innovation in all areas of the property industry, including exciting changes in the office sector, which leads to new and interesting investment strategies.”

iCalculations are made on fixed-exchange rates to eliminate currency impacts. Local currency values are converted to US$ using the average daily FX spot rate in Q3 2018.

iiValues include entity-level transactions and exclude development sites.

Research Contacts

Richard Barkham, Ph.D., MRICS

Global Chief Economist

CBRE Americas and Global Research

+1 214 979 6169

richard.barkham%m%cbre%d%com

Wei Luo

Senior Analyst, Capital Markets

CBRE Global Research

+1 212 984 8153

wei.luo%m%cbre%d%com