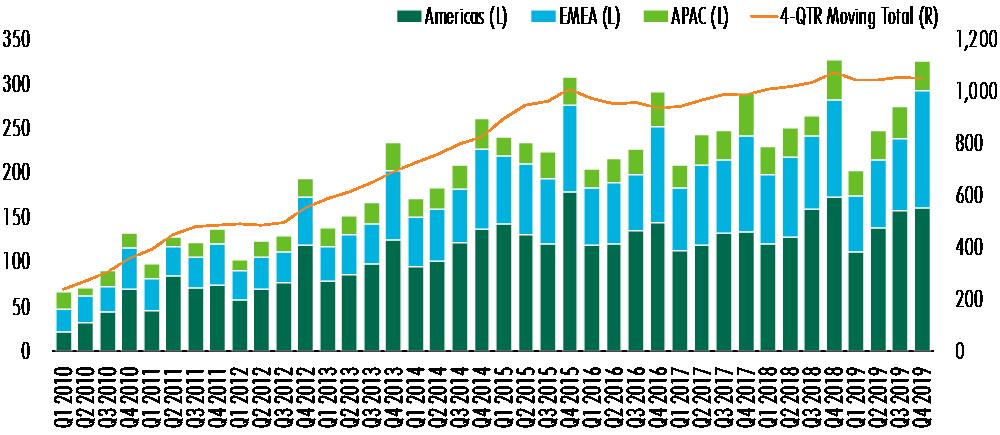

• Global commercial real estate (CRE) investment, including entity-level deals, totaled US$326 billion in Q4 2019, about level (-0.5%) with Q4 2018. For the full year, global volume was down slightly (-2%) from 2018.

• Excluding entity-level deals, global CRE investment volume rose by 9% year-over-year in Q4 to US$324 billion. Full-year global volume, excluding entity-level deals, was up by 5% from 2018.

• EMEA investment activity surged by 19% year-over-year in Q4, with high levels of investment throughout the region.

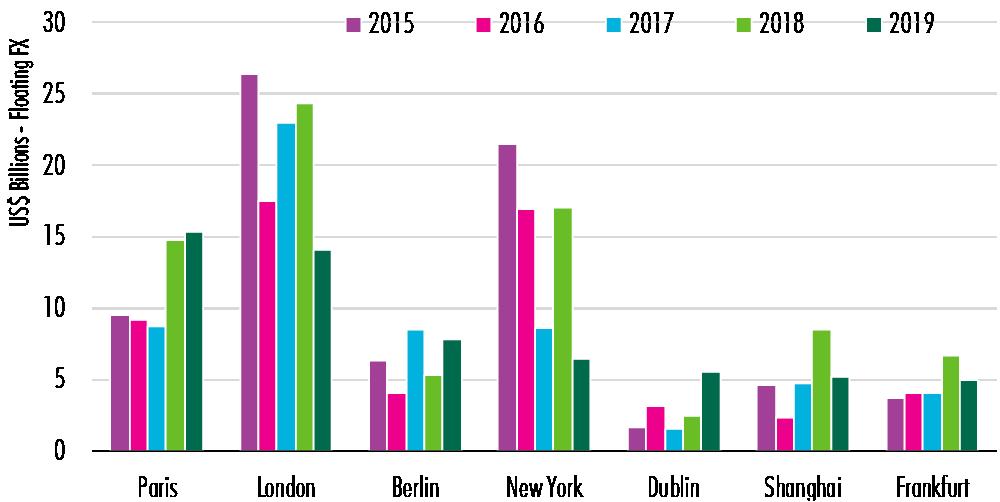

• In EMEA, Paris emerged as the top destination for foreign capital in 2019. Dublin also gained significant interest from foreign investors.

Global CRE investment volume in Q4, including entity-level deals, was nearly level (-0.5%) with Q4 2018, while full-year volume fell by 2% from 2018. Regionally, EMEA had substantial investment activity in Q4, up by 19% year-over-year and compensating for subdued activity in the previous three quarters. Americas investment volume fell by 6% year-over-year in Q4, while APAC saw a 27% decrease.

Figure 1: Global Commercial Real Estate Investment (US$ Billions - Fixed FX)

Source: CBRE Research, RCA (Americas), Q4 2019.

Total Americas investment volume fell by 6% year-over-year in Q4, while full-year volume fell by 2% to US$569 billion. However, excluding entity-level deals, the U.S. posted its best single-quarter volume in the past decade, increasing 11% year-over-year. Canada and Mexico investment also rebounded nicely in Q4. Softening in the region’s total volume stemmed from an 86% reduction in U.S. entity-level transactions.

The U.S. accounted for nearly half of global CRE investment volume in 2019. Despite constrained global market supply, low global bond yield expectations and falling hedging costs, investors should continue to favor U.S. CRE, as well as fuel a possible recovery of the mergers-and-acquisitions market.

EMEA investment volume grew by 19% year-over-year in Q4, while full-year volume fell by 2% to US$352 billion. Q4 investment activity fell year-over-year in Spain (-44%) and France (-3%) but grew in the U.K. (27%) and Germany (55%). The U.K.’s full-year volume fell by 19%, largely due to prolonged political uncertainty regarding Brexit, while France (12%) and Germany (8%) saw their full-year volumes rise moderately and reach new highs. Other European markets continued to attract capital in 2019 despite historically low prime yields, with Ireland (58%), Sweden (56%), Austria (39%) and Italy (37%) all seeing double-digit full-year growth.

Big-ticket transactions and renewed investor confidence inflated investment volumes throughout Continental Europe, with deal sizes larger than $100 million increasing 9% year-over-year. Furthermore, office and residential assets remained the most attractive. Investment volumes throughout Europe remained high, with mergers-and-acquisitions deals remaining prevalent. Additionally, the European Central Bank’s decision to lower interest rates and restart quantitative easing gave an added stimulus to investment volumes this quarter. In 2020, as Western European markets continue to return low yields, capital likely will look toward a recovering U.K. market and Central and Eastern Europe for higher returns on CRE investments.

APAC investment volume fell by 27% year-over-year in Q4, while full-year volume fell by 2% to US$131 billion—above the five-year average of US$125 billion. The decline in transaction volume was due to fewer big-ticket transactions than in Q4 2018 and a significant decline in Hong Kong investment volume due to ongoing political turmoil. Hong Kong’s Q4 2019 volume was the lowest quarterly total since the global financial crisis in 2008.

Nevertheless, several key APAC markets had increased investment volume in H2 2019. Australia and China had increases from domestic investors, while investment volume in Korea reached a record high, with office and logistics assets in highest demand. Japan continued to attract capital in 2019 largely due to its attractive yield spread offering.

The outbreak of the Wuhan coronavirus poses negative risks to investment sentiment in the region, with Greater China expected to have a slow start in Q1 2020. Investors likely will reduce their pace of investment and wait to determine the full extent of the outbreak.

Figure 2: Top Markets for Foreign Investment

Global cross-border investment volume rebounded slightly in Q4, but still declined 7% year-over-year. Full-year cross-border investment fell by 20% from 2018—a banner year with three of the five largest quarterly cross-border volumes on record. All three regions had declines in cross-border investment, led by the U.S. (-54%) due to slowing mergers-and-acquisitions activity. In Q4 alone, EMEA saw sizeable growth of 21% in cross-border investment. Paris was the top EMEA destination for foreign capital, after replacing London for the first time on record in Q3 2019. Dublin gained significant investor interest, particularly in Q4, likely on investor optimism regarding the Brexit deal.

CBRE’s forecast is for a stable investment market in 2020 but with some quarterly volatility along the way.

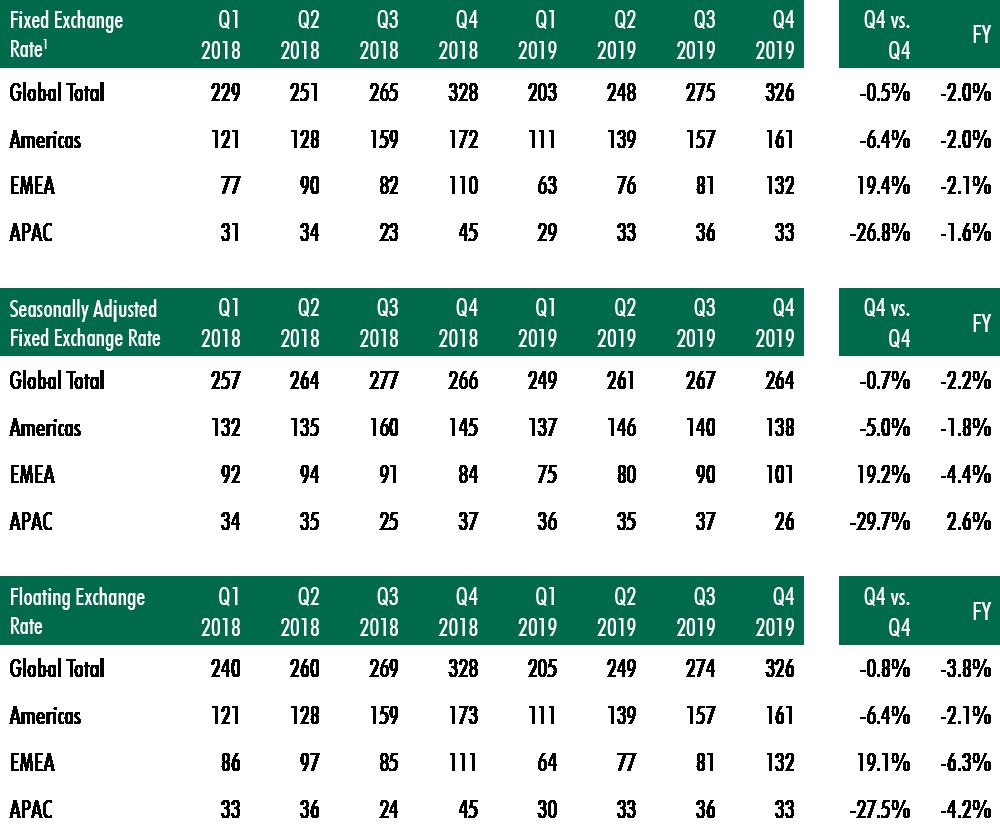

Figure 3: Total Value of Commercial Real Estate Investment Transactions (US$ Billions)2

Source: CBRE Research, RCA (Americas), Q4 2019.

1Values are not seasonally adjusted; include entity-level transactions and exclude development sites

2Measured in fixed US$ unless otherwise stated. Local currency values are converted to US$ using the most recent quarterly FX rates of Q4 2019. This calculation eliminates currency impacts over time and generates the same growth rates as in local currencies.

Appendix

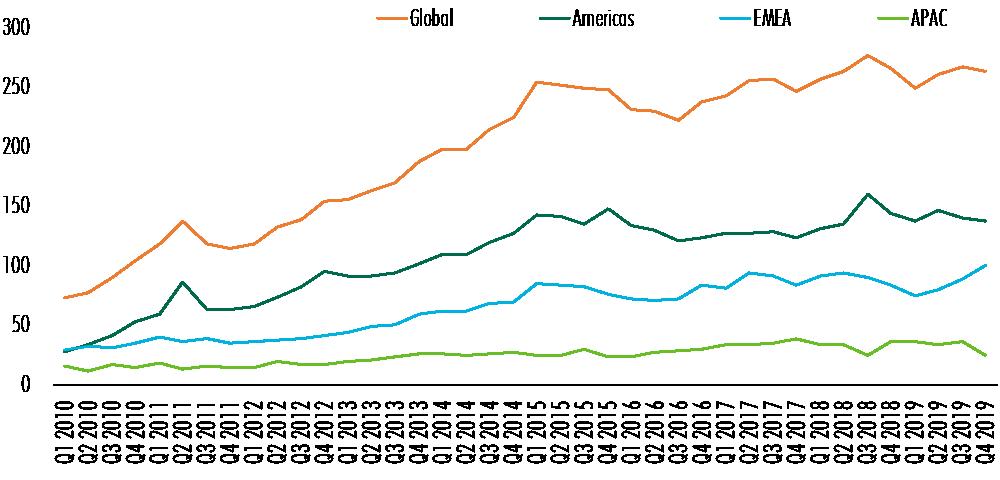

The seasonally adjusted figures are shown in Figure A1. These give a more accurate picture of transaction activity from quarter to quarter across any one year.

Figure A1: Seasonally Adjusted Investment Volume (US$ Billions - Fixed FX)

Source: CBRE Research, Q3 2019.

Research Contacts

Richard Barkham, Ph.D., MRICS

Global Chief Economist &

Head of Americas Research

+1 617 912 5215

richard.barkham%m%cbre%d%com

Daniel Chang

Research Analyst,

Global Capital Markets Research

+1 617 912 5254

daniel.chang%m%cbre%d%com

Wei Luo

Associate Director,

Global Capital Markets Research

+1 212 987 8153

wei.luo%m%cbre%d%com