Executive Summary

• U.S. GDP fell by 0.9% annualized in Q2 vs. consensus expectations of 0.3% growth. The drop was largely driven by decreases in consumer spending on goods and in business and residential investment.

• Although a second consecutive quarter of negative growth following a 1.6% drop in Q1 GDP is an indicator of recession, CBRE does not believe the U.S. economy is currently in one. However, we expect that a recession will take hold late this year and early next.

• The Federal Reserve raised the federal funds rate by 75 basis points (bps) yesterday to a target range of 2.25% to 2.5%.

• Slower economic growth likely will cause the Fed to limit any additional rate hikes this year to no more than 50 bps each. The central bank has three more meetings this year in September, November and December.

• The Fed indicated it will increase the ongoing reduction of its balance sheet to $95 billion from $47.5 billion per month beginning in September.

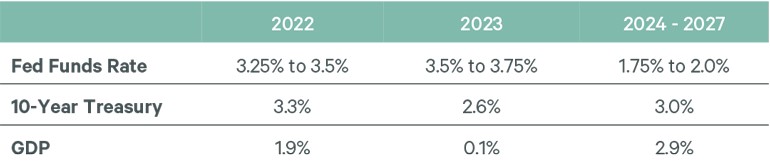

• CBRE forecasts the federal funds rate will peak at 3.75% next year.

• CBRE expects that more challenging economic conditions later this year and next will weigh on real estate market fundamentals and investment volumes.

Q2 2022 GDP

U.S. GDP fell by 0.9% on an annualized basis in Q2 2022. While this marks the second consecutive quarter of negative GDP growth—a commonly accepted definition of recession—we do not believe that the U.S. economy is currently in recession. This initial Q2 GDP estimate will be revised twice in coming weeks.

Negative growth in Q2 was largely driven by less consumer spending on goods, decreased residential and non-residential investment and a reduction in business inventories. The deceleration in consumer spending growth to just 1.0% in Q2 likely will weigh on demand for retail and industrial properties. The shift in spending from goods to services was amplified in Q2, with goods subtracting 1.08% from GDP and services adding 1.78%. On a positive note, investment in intellectual property (tech) —an important driver of office demand—increased by 9.2% annualized, which is a positive indicator for the hard-hit office sector.

July FOMC Meeting

The Federal Reserve raised interest rates by 75 bps yesterday to a target range of 2.25% to 2.5%. This move continues the central bank’s efforts to cool the labor market and high inflation, which reached a 40-year-high of 9.1% in June.

Additionally, the Fed signaled it will increase the ongoing reduction of its balance sheet—a process known as quantitative tightening—to $95 billion from $47.5 billion per month beginning in September.

CBRE Forecast

As economic growth slows, the Fed will struggle to balance its dual mandate of price stability and full employment. We expect the Fed will continue to favor price stability and take actions to reduce economic activity and job growth. Consequently, we expect the federal funds rate to reach a range of 3.25% to 3.5% by year-end and unemployment to begin to rise.

Rapidly increasing interest rates and subdued economic growth will weigh on commercial real estate fundamentals and investment volumes this year and next. Segments of the multifamily, hotel and retail sectors that rely on budget-conscious consumers will be particularly affected.

Figure 1: CBRE House View*