Executive Summary

• U.S. GDP increased by 2.6% annualized in Q3 vs. consensus expectations of 2.3%. Net exports, government expenditures and spending on services were the main drivers of growth.

• The rebound in GDP supports our view that the U.S. economy is not yet in recession but likely will contract in the first half of 2023.

• Although there are signs of significant slowing in certain areas of the economy—most notably in residential investment—the Fed likely will continue its aggressive approach to contain inflation, with another 75-basis-point hike expected in November.

• CBRE expects that economic growth will slow later this year and next, which will weigh on real estate demand and investment activity.

Q3 2022 GDP

U.S. GDP increased by 2.6% on an annualized basis, exceeding consensus expectations of 2.3%. Although this rebound is welcome after two consecutive quarters of negative growth, there clearly are indications that the economy is slowing. For example, the jump in net exports likely won’t be sustainable as the global economy slows and the strong dollar makes U.S. goods more expensive overseas. Spending on services cooled significantly on a quarter-over-quarter basis, continuing a downward trend this year.

Parts of the economy that are sensitive to interest rates have weakened significantly. For example, residential investment contracted by 26.4% on an annualized basis in Q3. There was also weakness in durable goods, such as motor vehicles and parts. Personal consumption has slowed dramatically from 2021’s robust rates of growth, coming in at just 1.4% annualized inQ3 2022

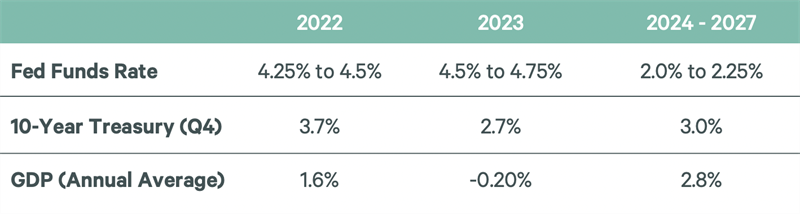

CBRE Forecast

We expect the U.S. economy will enter a recession in the first half of 2023. Although we do not expect a steep downturn, there are downside risks that the rapid rise in interest rates could impact stability in financial markets. This anticipated slowdown will also impact employment levels and we expect the unemployment rate will increase to 4.7% by the end of 2023 from its current level of 3.5%. As the economy cools and the labor market softens, we expect lower inflation, prompting the Fed to moderate and conclude its rate increases in 2023.

This expected slowdown in the broader economy means that real estate fundamentals likely will soften. We expect the yield on the 10-year Treasury to fall back to 2.7% by year-end 2023, which will aid in the recovery of real estate investment volume.

Figure 1: CBRE House View