Executive Summary

• As expected, the Federal Reserve raised the federal funds rate by 50 basis points (bps) yesterday to a target range of 0.75% to 1.0%. This was the biggest rate hike since 2000.

• The Fed also announced that it will begin reducing its balance sheet in June. The Fed will initially begin to decrease its portfolio of government and mortgage-backed bonds by $47.5 billion per month, with reductions reaching $95 billion per month beginning in September.

• Amid persistently high inflation, CBRE forecasts at least one additional 50-bp rate hike, followed by 25-bp increases later this year. The federal funds rate should reach a target of 2.0% to 2.25% by the end of 2022.

• CBRE continues to expect healthy real estate fundamentals and investment volume in 2022, though more challenging economic conditions likely will weigh on activity in the second half.

May FOMC Meeting

The Federal Reserve raised interest rates by 50 bps yesterday to a target range of 0.75% to 1.0%. The increase was expected as inflation is running at its highest level in 40 years amid a historically strong labor market.

Additionally, the Fed will begin to reduce its $8.9 trillion balance sheet by $47.5 billion per month—a process also known as quantitative tightening—in June. These reductions will accelerate after three months and reach $95 billion per month beginning in September. This is a significantly faster pace of reduction than in the 2018-19 tightening cycle.

CBRE Forecast

Supply-chain disruptions, high labor demand and rising food and energy prices will continue to fuel inflation in 2022. Consequently, CBRE expects inflation to remain elevated for the rest of the year, with the Consumer Price Index (CPI) averaging 7.7% before slowing to an average of 3.3% in 2023.

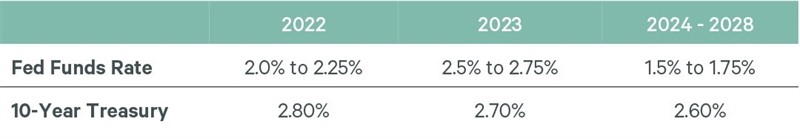

We expect another 50-bp increase in the federal funds rate in June, followed by 25-bp increases later in the year. CBRE expects a federal funds rate range of 2% to 2.25% by the end of 2022.

Figure 1: CBRE House View

Even amid this monetary policy tightening, we expect U.S. GDP growth above trend (2%) for 2022, which will support commercial real estate fundamentals. With a significant amount of capital targeting property markets, we anticipate full-year investment volume will be very near 2021’s record level.

A panel of CBRE experts will discuss the impacts of this latest rate hike on Tuesday, May 10 at 2PM ET. Look for an invitation later today or register now to reserve your spot.