Executive Summary

• The Federal Reserve today raised the federal funds rate by 75 basis points (bps) for the fourth time this year, taking it to a range of 3.75% to 4.0%.

• The Fed will continue the reduction of its $8.8 trillion balance sheet by $95 billion per month. This will increase long-term interest rates, raising the cost of debt for real estate.

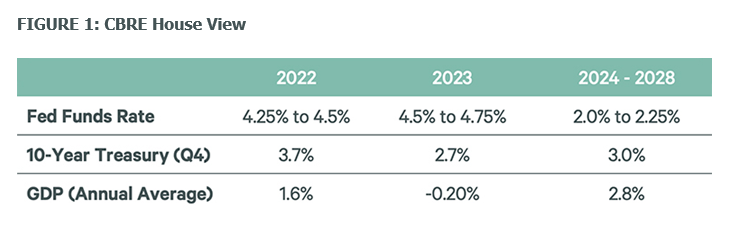

• CBRE expects a recession next year, with the federal funds rate peaking at just over 4.5%. This will continue to weigh on commercial real estate investment and leasing activity.

November FOMC Meeting

The Federal Reserve announced its fourth consecutive 75-bp rate hike this year, bringing the federal funds rate to a range of 3.75% to 4.0%. We expect the Fed will begin to taper the size of increases, starting with a likely 50-bp hike in December. The Fed also signaled its continued quantitative tightening campaign by reducing the size of its balance sheet by $95 billion per month.

The Fed indicated that it will maintain monetary policy that is “sufficiently restrictive to return inflation to 2% over time.” However, it will also consider the cumulative effect of tightening on the economy and financial system. Financial markets broadly interpreted this as a signal that future rate hikes will not be as large.

The Bottom Line

We continue to see signs that inflationary pressures have peaked. This, combined with the lagged effects of monetary policy that will slow demand, should take pressure off the Fed to act as aggressively in 2023. We expect the federal funds rate to reach a range of 4.5% to 4.75% next year.

Although we expect a recession in 2023, real estate capital markets should begin to improve in Q2, with a broader recovery, including leasing, taking hold later in the year.