Executive Summary

• In response to persistently high inflation that reached a 40-year high in May, the Federal Reserve raised the federal funds rate by 75 basis points (bps) today to a range of 1.50% to 1.75%. This was the biggest rate hike since 1994.

• The Fed raised its outlook for core inflation (Core PCE), which excludes food and energy, to 4.3% and lowered its GDP growth forecast to 1.7%.

• With elevated inflation expected to persist, the Fed likely will continue to focus on easing price pressures, with the potential for increases of at least 50 bps at its next two meetings in July and September.

• The Fed will reduce its $8.9 trillion balance sheet by $47.5 billion per month beginning this month. The reduction in Treasury securities, agency debt and agency mortgage-backed securities will increase to $95 billion per month in September.

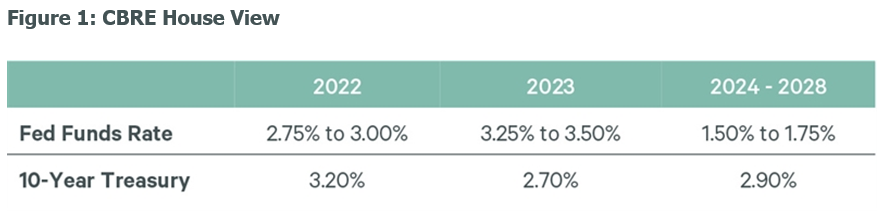

• CBRE expects economic activity will slow but that a recession is unlikely this year. Amid slower growth and high inflation, CBRE forecasts the federal funds rate will peak at 3.5% in 2023.

• Volatility in the credit markets is causing issues for investors, but activity in the commercial real estate markets has remained resilient as sellers expedite dispositions. However, we expect higher rates and slower growth will weigh on activity as the year goes on.

The June FOMC Meeting

The Federal Reserve raised interest rates by 75 bps today to a target range of 1.50% to 1.75%, the largest increase since 1994. As of last week, financial markets largely anticipated only a 50-bp increase. This changed when the May Consumer Price Index came in above expectations at 8.6%, causing the Fed to take more aggressive action to combat rising prices.

Additionally, the Fed affirmed plans to shrink its $8.9 trillion balance sheet. Beginning this month, the Fed will reduce its holdings of Treasury securities, agency debt and agency mortgage-backed securities by $47.5 billion per month. The reduction will increase to $95 billion per month beginning in September. This “quantitative tightening” process will further decrease liquidity in financial markets and contribute to increased volatility.

The Bottom Line

The strong U.S. labor market makes taming inflation the Federal Reserve’s top priority. CBRE expects the Fed will increase interest rates by at least 50 bps at each of the next two FOMC meetings in July and September, putting the federal funds target range to between 2.75% and 3.00% by the end of the year.

Higher interest rates should cool the extraordinary demand that has fueled inflation amid supply disruptions. While a recession does not appear imminent in the near term, risks of one—particularly in 2023—are building.

Lower economic growth should still support continued strong commercial real estate fundamentals this year. Tightening in credit markets will continue to drive adjustment in the commercial real estate investment markets in the near term. Amid this uncertain and dynamic environment, investment market performance will be uneven with investors favoring high-quality assets in liquid or high-performing markets. We anticipate this to be the case across property types as investors look to lower risk.