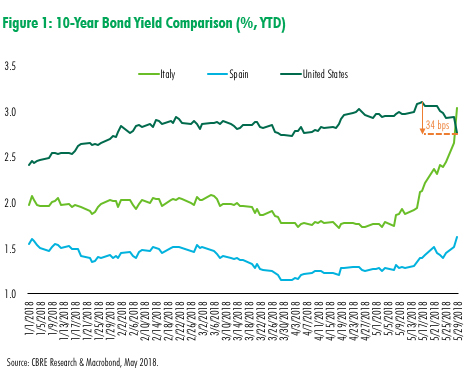

On May 29th, Italian bond yields recorded their largest one day jump for 26 years, having risen by over 100 basis points (bps) in two weeks. Yields in Spain have also risen. At the same time, the U.S. 10 Year Treasury has fallen by 34 bps since mid-May, reversing a long period of steady increase (See Figure 1). Why it has happened and what it means for commercial real estate are the subject of this MarketFlash.

• The Italian political crisis represents a material increase in risk to the Eurozone economy, but should be resolved in the short to medium term;

• The crisis has highlighted the role of U.S. Treasuries as the world’s preferred risk-free asset and yields have fallen substantially;

• We expect commercial real estate debt costs to fall with stable spreads. This presents investors significant opportunities to lock in lower fixed mortgage rates;

• At this point, the crisis looks to be overall beneficial to the U.S. real estate market.

The Italian economy is the third largest in the Eurozone and the eighth largest in the world. Its politics influence global markets, particularly in the context of the European Union, which has just lost one member through Brexit.

Italy has a high ratio of government debt to GDP (132%) and its banking sector a high proportion of non-performing loans. In recent years the Italian government has made substantial progress in reducing the government deficiti and more recently the economy has returned to growth.

Elections in March 2018 produced a good showing for parties that want to expand government spending. These parties, namely the League (Lega) and the Five Star Movement (M5S), are also somewhat opposed to the economic policies of the European Union, even to the point of potentially wanting Italy to exit the Eurozone. Over the weekend, the Italian President exercised his authority to block the formation of a League-Five Star coalition government, triggering market turmoil and making it likely a new election could be called. Polling suggests that the anti-EU, pro-public-spending parties will do even better in the next election.

Why does this worry the markets? Firstly, the parties have suggested policies that amount to debt forgiveness: which is not far from default. Second, greater public spending means a higher debt burden on the Italian economy, without any promise of economic success. More debt means a greater chance of default and the possibility that the ECB may not be willing to intervene to buy troubled sovereign bonds of a member state that is not committed to fiscal prudence. Third, the problems in Italy highlight the fiscal and political problems elsewhere, notably in Spain. There is more than a hint of the sovereign debt crisis that blighted the European and world economy in the 2012 to 2014 period. This leads some to conclude that, at some point, Italy’s only hope will be to crash out of the Euro and devalue its currency.

We do not believe that this will happen. Italy is a founding member of the European Union and its political class believe deeply in the ideals of European Union. We also note that this is the 64th political crisis in Italy since the Second World War – these have a tendency of being resolved. There are already signs that the parties are modifying their positions.

We believe that investors are correct in demanding higher risk premiums in the European government debt and the U.S. Treasuries will experience a period of respite from the slow but firm increase. The U.S. bonds remain, indisputably, the world’s risk-free asset of choice. Moreover, the fall in bond yields will likely ripple through debt markets and open a window for investors to lock in financing at rates that will quickly disappear.

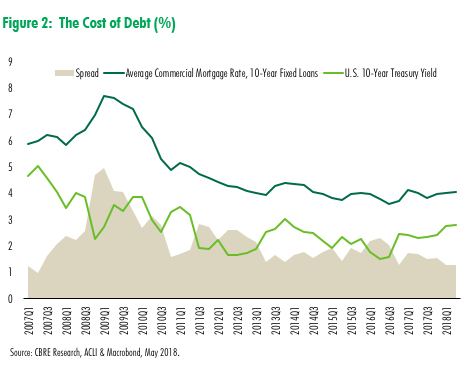

Figure 2 shows the relationship and spread between fixed commercial mortgage rate and the U.S. 10-year Treasury yield, with the former closely affected by the latter. Notably the spread is at the lowest since Q1 2007 but remains well above 100 bps. According to Mitchell Kiffe, Senior Managing Director of Debt & Structured Finance at CBRE, neither Fannie Mae and Freddie Mac expect to widen credit spreads in the near future and both are eager to rate-lock businesses amid recent volatility.

Overall, the rising risk in European bonds benefits the U.S. real estate market. We expect cap rates to remain firm at current levels with improved spreads, and debt costs to fall in commercial real estate. Investors should take advantage of the low mortgage rates. They will not last very long as we expect the crisis to ease.

________________________________________

iThe balance between tax and other revenues and public spending.

Contacts

Richard Barkham, Ph.D., MRICS

Global Chief Economist

CBRE Americas and Global Research

+1 617 912 5215

richard.barkham%m%cbre%d%com

Spencer G. Levy

Head of Research | Senior Economic Advisor

CBRE Americas Research

+1 617 912 5236

spencer.levy%m%cbre%d%com

Wei Luo

Senior Analyst, Capital Markets

CBRE Global Research | Econometric Advisors

+1 212 984 8153

wei.luo%m%cbre%d%com