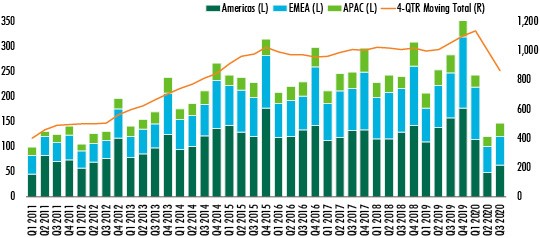

• Global commercial real estate investment increased by 23% quarter-over-quarter in Q3 but was still down by 48% year-over-year. Year-to-date global volume is down by 31% from 2019.

• Effective management of the pandemic was a major factor behind the investment recovery in Q3. Markets in Asia and Europe, including South Korea, Taiwan and the U.K., led the rebound.

• Investors strongly favored industrial & logistics assets. Office assets were less popular in most developed markets but continued to attract significant capital flows in high-growth markets like India.

A gradual recovery has begun in commercial real estate investment. Global property sales grew 23% quarter-over-quarter in Q3 to US$147 billion, lifted especially by a 34% rebound in the U.S. On a year-over-year basis, global investment volume fell by 48% in Q3 and 31% year-to-date.

Investor sentiment has risen greatly in Asia, where the rate of COVID-19 infections has eased. The same was true in parts of Europe, but a recent resurgence of infections in countries like France and Italy threatens to derail the recovery. In the Americas, despite the broader economic recovery, investors remain in a period of price discovery and risk aversion.

Figure 1: Global Commercial Real Estate Investment (US$ Billions - Fixed FX)

Source: CBRE Research, Real Capital Analytics, Q3 2020.

Americas

Americas investment volume increased by 30% quarter-over-quarter to US$64 billion, back to the level of 10 years ago. The U.S. accounted for 96% of the region’s investment activity. However, a 59% year-over-year decline in Q3 and 44% decline year-to-date in the Americas were the largest among all three global regions. The Americas had no entity-level transactions for the second consecutive quarter.

Activity increased across all property sectors in Q3, led by a strong quarter-over-quarter rebound in multifamily investment. With a relatively stable outlook for demand and income, multifamily has been the most popular asset type in the Americas since 2017. On a year-to-date basis, industrial & logistics has the smallest decrease in investment volume at 25%. Pricing of multifamily and industrial assets has recovered quickly as they are sought-after for downturn protection. Investment yield has also remained stable.

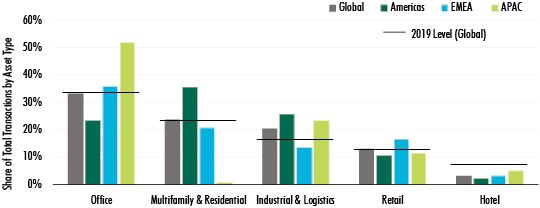

Office, on the other hand, had the smallest (9%) quarter-over-quarter rebound due to continued uncertainty about long-term office usage in urban markets, such as New York and San Francisco. The sector’s share of total investment in the Americas decreased to 23% in Q2 and Q3 from 25% in 2019 (Figure 2). The hotel and retail sectors were the most severely impacted, with respective 73% and 46% drops in investment volume year-to-date.

Figure 2: Investment Preferences in Q2 & Q3 2020

Source: CBRE Research, Q3 2020.

EMEA

EMEA investment volume increased by 11% quarter-over-quarter in Q3 to US$57 billion but was down by 37% from a year ago. Year-to-date volume was 11% lower, the smallest decrease among all three global regions due to record-setting volume in Q1. Approximately half of the region’s markets had a rebound, while the other half slowed further.

The U.K., France and Ireland drove the region’s Q3 investment rebound. U.K. investment volume increased by 104% quarter-over-quarter, driven by robust growth in the residential and industrial sectors. Germany (+10%), Switzerland (+26%) and Belgium (+41%) demonstrated strong year-to-date investment growth. However, activity remained subdued in some markets, including the Netherlands and Sweden. A recent resurgence in COVID-19 cases poses serious threats to the region’s recovery.

On the sector level, industrial & logistics (+60% quarter-over-quarter) and office (+20% quarter-over-quarter) led the region’s investment rebound. Notable transactions included GLP’s US$1.3 billion acquisition of Goodman Group’s logistics portfolio in Central and Eastern Europe. Industrial yield stayed at a historical low. Office yield is falling in markets like Paris and Hamburg, as companies expand outside of the U.K. in response to Brexit.

Residential’s share of total investment has increased by 4% during the pandemic. This growth should continue as investable residential inventory grows in Europe. Retail had a smaller-than-expected drop in investment (-17% year-over-year) and accounted for 16% of total transactions (Figure 2). Demand for retail assets remained surprisingly healthy in Germany, Switzerland and the U.K. Hotel investment volume fell by 68% year-over-year, largely due to ongoing travel restrictions.

APAC

APAC investment volume increased 38% quarter-over-quarter to US$26 billion, leading all global regions. Year-over-year volume fell by 27% in Q3, an improvement from the 41% decline in Q2. Nevertheless, investors remain increasingly selective and strategic during the pandemic.

South Korea, Taiwan and India led the region’s Q3 recovery. South Korea and Taiwan have been particularly strong in virus containment and economic reopening. Despite a continued high COVID-19 infection rate, India—the world's preferred outsourcing destination—remains a top investment target. For example, Brookfield recently acquired an office portfolio, including a co-working business, from Indian developer RMZ for approximately US$2 billion. This was the largest real estate deal in Indian history. Blackstone is reportedly buying another US$2 billion worth of office and retail assets in India.

Year-to-date, investment volume has stabilized with relatively small decreases in China (-26%) and Japan (-15%). But markets that rely more on international capital flows, such as Hong Kong, Singapore and Australia, face steeper challenges. Their recovery trajectory will be closely tied to the development of a vaccine.

Industrial investment volume increased by 66% year-over-year, leading all property sectors in Q3. Industrial’s share of total investment jumped to 23% in Q3 from 12% pre-pandemic (Figure 2), reflecting a forceful secular shift in logistics demand. Office still held the lion’s share of total investment. Office investment volume was up 30% from Q2 and down 26% year-over-year. Investors remain the most confident in highly developed cities like Seoul, Shanghai, Beijing, Sydney and Tokyo, all of which drew a greater share of investment during the downturn.

Retail investment volume fell by 70% year-over-year, while hotel investment fell by

65%. Both sectors provide investors significant discount opportunities with long-term growth potential in consumer spending and tourism once the pandemic ends.

Forecast

Global real estate investment is expected to continue a modest recovery until a COVID-19 vaccine becomes available and is widely distributed. As this is unlikely to occur this year, CBRE estimates that investment will remain relatively weak in Q4, resulting in a full-year decline of roughly 38%. This is better than the last global recession when global investment fell by 58% in 2008.

As vaccine research forges ahead, a global market normalization is highly anticipated in 2021. Interest rates and Treasury yields will stay low, giving commercial real estate an edge on returns. Capital targeting real estate has remained high. Investors who delayed capital deployment this year will look for risk-adjusted opportunities or adopt different strategies in 2021 and beyond.

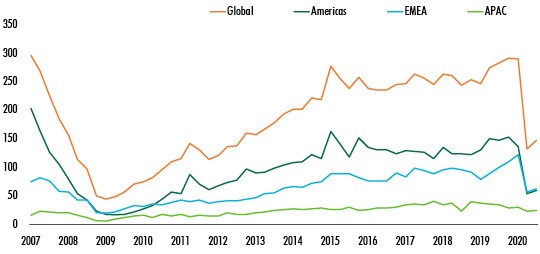

Figure 3: Total Value of Commercial Real Estate Investment Transactions

(US$ Billions)*

Source: CBRE Research, Real Capital Analytics, Q3 2020.

*Values include entity-level transactions and exclude development sites.

**In order to calculate global totals, local currency values are converted to US$ using the most recent quarterly FX rates of Q3 2020. This calculation eliminates currency impacts over time and generates the same growth rates as in local currencies.

Appendix

The seasonally adjusted volumes are shown in Figure A1. These give a more accurate picture of transaction activity from quarter to quarter across any one year.

Figure A1: Seasonally Adjusted Investment Volume (US$ Billions - Fixed FX)

Source: CBRE Research, Real Capital Analytics, Q3 2020.

________________________________________

Contacts

Richard Barkham, Ph.D., MRICS

Global Chief Economist & Head of Americas Research

CBRE Americas and Global Research

+1 617 912 5215

richard.barkham%m%cbre%d%com

Wei Luo

Associate Director

Global Capital Markets Research

+1 212 987 8153

wei.luo%m%cbre%d%com

Daniel Chang

Research Analyst

Global Capital Markets Research

+1 617 912 5254

daniel.chang%m%cbre%d%com