Executive Summary

• The Federal Reserve’s hawkish stance to reduce inflation resulted in higher borrowing costs, more conservative underwriting and lower loan closing volume in Q3.

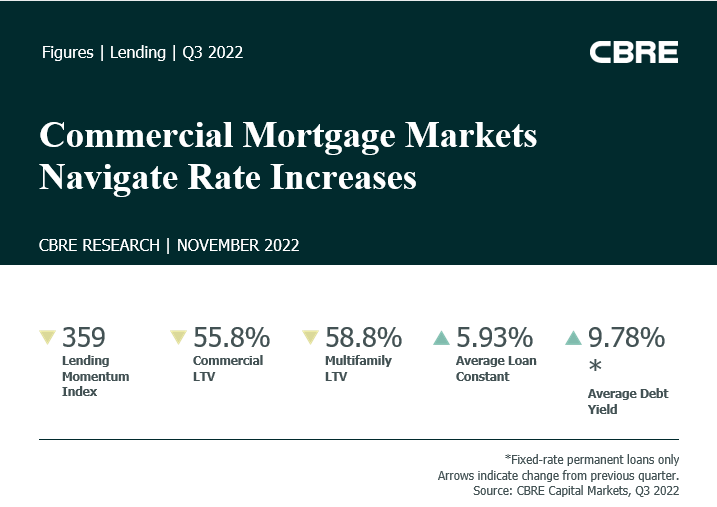

• The CBRE Lending Momentum Index fell by 11.1% quarter-over-quarter and 4.7% year-over-year in Q3.

• Spreads on seven- to 10-year, 55%-to-65%-loan-to-value (LTV) fixed-rate permanent loans widened for the second consecutive quarter. Commercial spreads widened 3 basis points (bps) to 190, while multifamily spreads widened 4 bps to 176.

• Banks were the top non-agency lending group for the second consecutive quarter. Alternative lenders’ activity was restrained by a challenging collateralized loan obligation (CLO) market. CLO issuance fell to only $3.39 billion in Q3 from $12.3 billion in Q2.

• CMBS issuance also slowed in Q3 amid market volatility and rising spreads. Spreads on 10- year AAA CMBS bond issues reached swaps +178 bps in late October, up approximately 20 bps from June.

• Higher mortgage rates and loan constants contributed to lower loan-to-value ratios, while underwritten cap rates and debt yields increased. Despite these changes, the percentage of loans carrying interest only terms increased to an average of 63.8% in Q3.