August 2020

Investor Pre-purchase Activity Up Strongly from COVID-19 Low

CBRE Deal Flow—the firm’s proprietary digital marketing hub for property sales—indicates that investor sentiment and transaction activity in commercial real estate are recovering from the depths of the COVID-19 crisis.

Nearing the end of July, the number of signed confidentiality agreements was down by only 17% year-over-year—a marked improvement from the 74% drop-off in April and May (Figure 1). This measure of revived investor interest could be a harbinger of a future rebound in commercial real estate transaction volume.

Figure 1: The Rebound of Investor Inquiries (Y-o-Y, 4-week moving average)

Source: CBRE Deal Flow, July 2020.

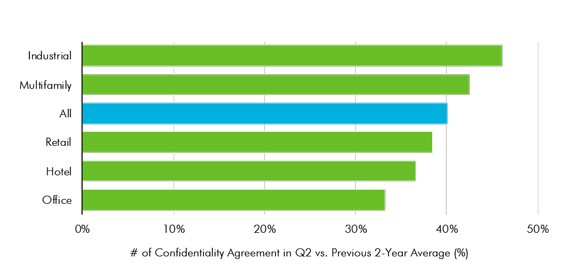

Signed confidentiality agreements in Q2 2020 for industrial and multifamily property offerings reached 46% and 42%,1 respectively, of the past two years’ average Q2 level (Figure 2). Lockdown measures due to COVID-19 have spurred higher e-commerce growth, particularly online grocery shopping. Expansion of supply chains and retailers’ omnichannel presence will propel continued demand for logistics facilities and warehouses.

COVID health concerns and the potential for companies to more enthusiastically embrace remote-working arrangements have weakened the rental outlook for some office properties. Operational office assets, such as life sciences facilities, data centers and single-tenant buildings, are more resistant to downturn risks and offer investors income stability. The rising popularity of operational office has buoyed total transaction levels and led to a material pick-up in the average price per sq. ft. of property sales.

Figure 2: Industrial and Multifamily Lead Recovery in June

Source: CBRE Deal Flow, Q2 2020.

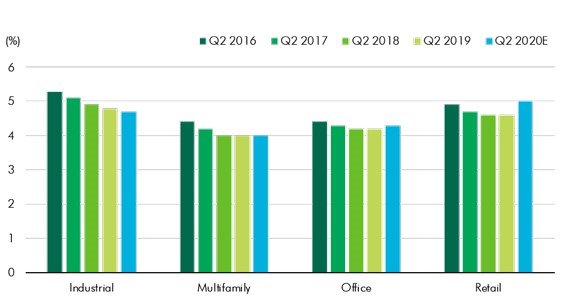

Many investors are requesting price reductions. Property values are expected to decline 10% to 20% by year’s end, causing a moderate rise in cap rates. While this trend was not fully manifested in Q2 2020 due to limited transaction activity, July sales indicate cap rates of Class-A industrial and multifamily assets were more stable in Q2 compared with other asset types (Figure 3).

Figure 3: Class-A Cap Rate by Asset Type

Source: CBRE Econometric Advisors, Q2 2020.

Looking ahead, an eventual recovery of transaction activity will be led by value-add investors with abundant capital and risk-averse investors seeking an alternative to low-yielding bonds, allowing cap rates to return to pre-COVID levels within three years.

1 Calculated by dividing the total number of signed confidentiality agreement in Q2 2020 by the average of Q2 2018 and Q2 2019.

________________________________________

Register your investment preferences on CBRE Deal Flow to get notified of the latest opportunities that meet your criteria.

Contacts

Chris Ludeman

Global President

CBRE Capital Markets

chris.ludeman%m%cbre%d%com

Kevin Aussef

Global Chief Operating Officer

CBRE Capital Markets

kevin.aussef%m%cbre%d%com

Richard Barkham, Ph.D., MRICS

Global Chief Economist & Head of Americas Research

CBRE Americas and Global Research

richard.barkham%m%cbre%d%com

Wei Luo

Associate Director

Global Capital Markets Research

wei.luo%m%cbre%d%com