Read this Brief on the web | Share on social: LinkedIn | Twitter

A record 63 signings for 1 million sq. ft. or more were among the top 100 industrial lease transactions in 2022, up from 57 in 2021. The top 100 in 2022 had an average size of 1.07 million sq. ft., compared with 1.05 million sq. ft. in 2021. Twenty-four of the top 100 were renewals, six more than in 2021, indicating that more occupiers are opting to remain in their current facilities.

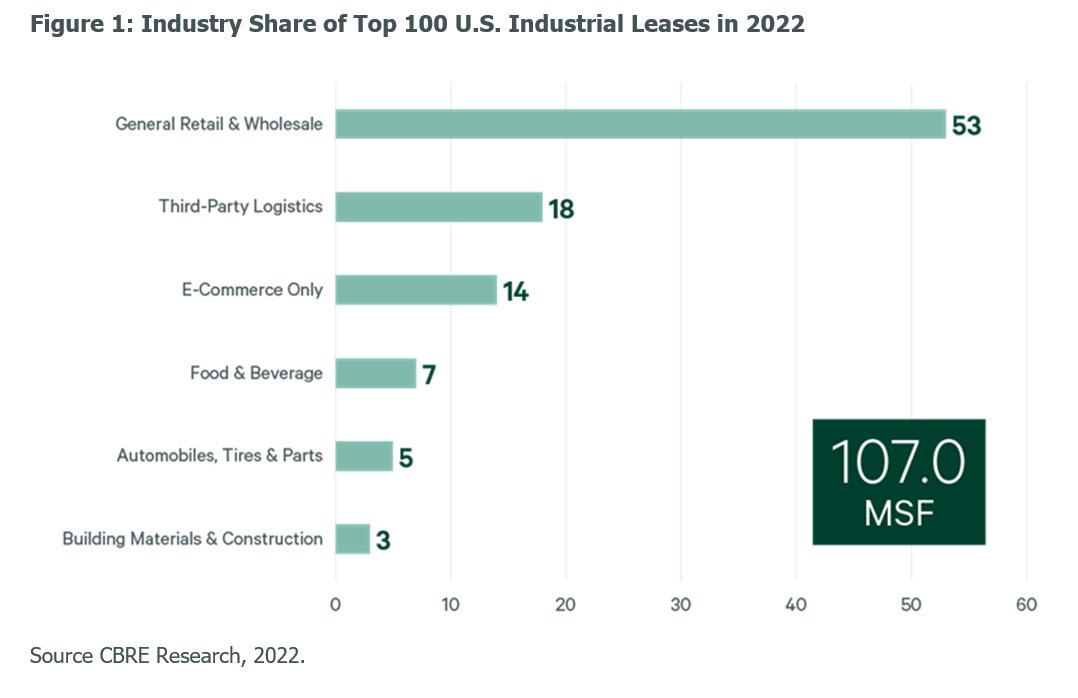

Traditional retailers/wholesalers accounted for 53 of the top 100 deals, expanding their footprints to accommodate e-commerce sales growth and store more inventory. Third-party logistics (3PL) operators signed 18 of the top leases, up from only 10 in 2021 and seven of which were for 1 million sq. ft. or more versus just two in 2021. E-commerce companies followed with 14 of the top 100, down from 21 in the previous year.

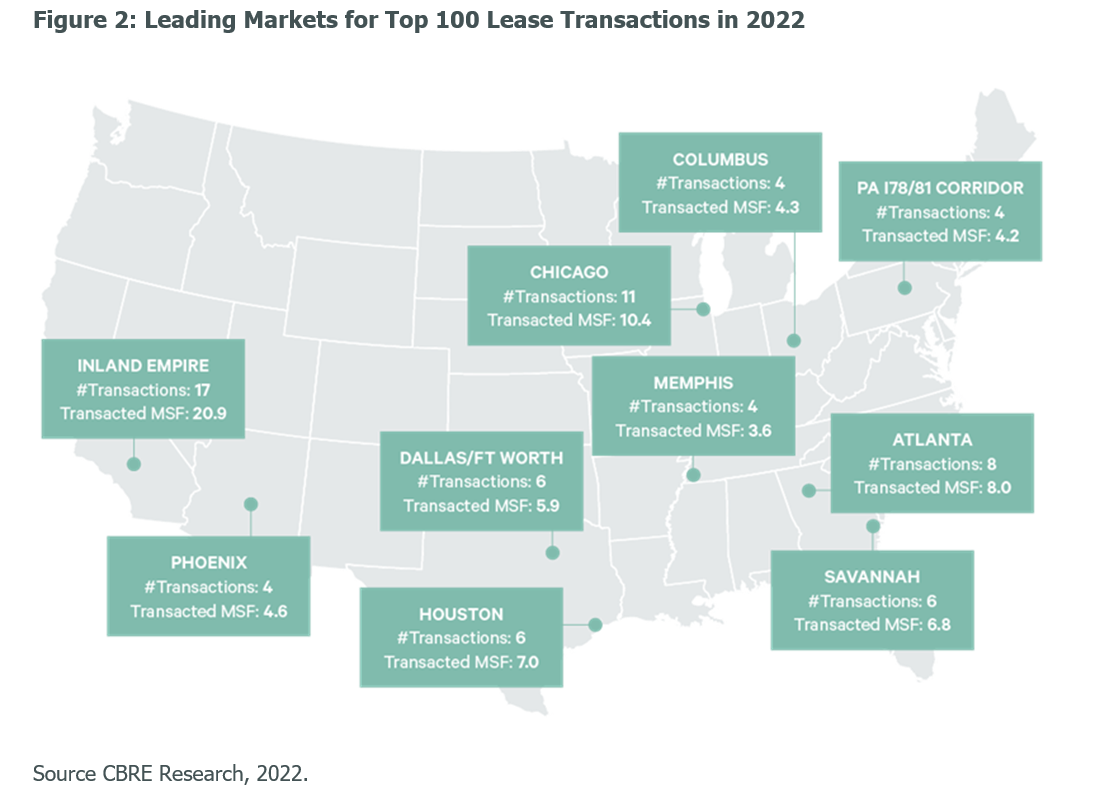

Inland Empire, CA led all markets with 17 of the top 100 leases, including a record 11 of 1 million sq. ft. or more. Chicago followed with 11 of the top 100. Savannah was the top emerging market with six of the top 100, up from just one a year ago. Strong demand for mega distribution centers is expected to continue in 2023. A large increase in construction will provide more opportunities for expansion, particularly in markets with the highest rates of speculative development like Dallas/Fort Worth, Atlanta, the Inland Empire, Phoenix and Indianapolis.

The smallest lease in the top 100 was for 760,000 sq. ft. Deals for 750,000 sq. ft. and above were the second most on record, surpassed only by 2021. Despite a possible economic slowdown, leasing of mega big-box facilities will remain solid this year as many occupiers shore up their e-commerce and inventory protection capabilities.